Miles For Taxes 2024. Irs mileage rates for 2023. The 2024 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year the 2024 medical or moving rate is 21 cents per mile, down from 22 cents per mile last.

(business mileage x mileage deduction rate) +. That drops to 14 cents per mile when.

For The 2023 Tax Years (Taxes Filed In 2024), The Irs Standard Mileage Rates Are:

The new irs mileage rates for 2024 are 67 cents per mile for business purposes (up from 65.5 cents per mile in 2023), 21 cents.

Mileage Rate Increases To 67 Cents A Mile, Up 1.5 Cents From 2023.

For cardup, both the admin fee and the tax payment earn miles, so a s$1,000 payment with a 1.75% fee placed on a 1.2 mpd card earns 1,221 miles.

8, 2024 — The Internal Revenue Service Today Announced Monday, Jan.

Images References :

Source: mileiq.com

Source: mileiq.com

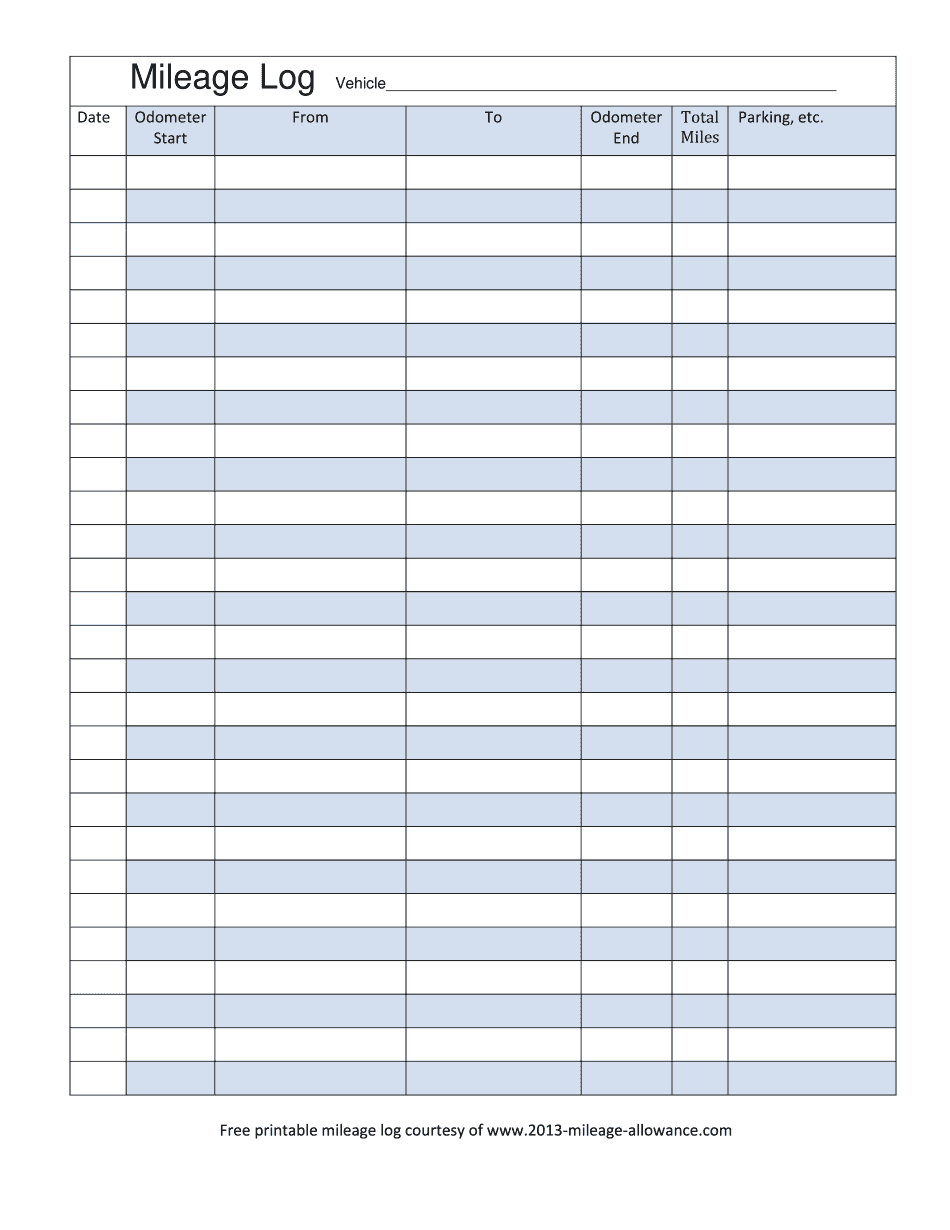

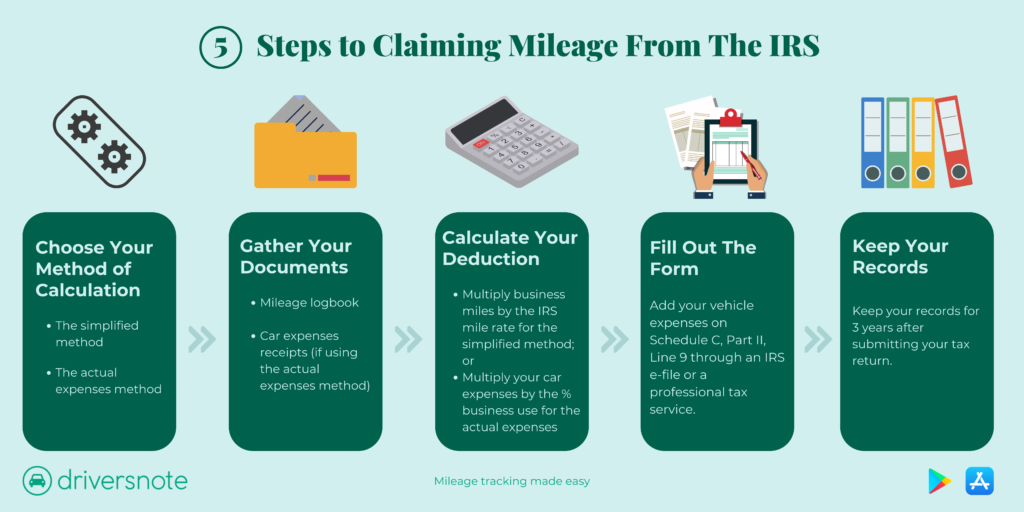

Mileage Log for Taxes Requirements and Process Explained MileIQ, In addition to providing the number of miles driven during the tax year, you’ll also need to answer a few questions about the vehicle, including when it was placed into service for. For tax year 2023 (the taxes you file in 2024), the irs standard mileage rate is 65.5 cents per mile when used for business.

Source: joeyqleontine.pages.dev

Source: joeyqleontine.pages.dev

Irs Electric Vehicle Mileage Rates 2024 Annie, For tax year 2023 (the taxes you file in 2024), the irs standard mileage rate is 65.5 cents per mile when used for business. In this example, your total deductible mileage related expenses would be.

Source: lesboucans.com

Source: lesboucans.com

Mileage Log Template For Taxes For Your Needs, For the 2023 tax years (taxes filed in 2024), the irs standard mileage rates are: To calculate your mileage tax deduction and reduce your taxes, use this formula:

Source: linniewlou.pages.dev

Source: linniewlou.pages.dev

Irs Reimbursement Rate For Mileage 2024 Livvy Quentin, Mileage rate increases to 67 cents a mile, up 1.5 cents from 2023. You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving.

Source: mileagetip.com

Source: mileagetip.com

Mileage Allowance Free Printable Mileage Log 2024 Form Printable Blank PDF Online, 2,000 charitable miles x.14 = $280. For tax year 2023 (the taxes you file in 2024), the irs standard mileage rate is 65.5 cents per mile when used for business.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, 65.5 cents per mile for. For cardup, both the admin fee and the tax payment earn miles, so a s$1,000 payment with a 1.75% fee placed on a 1.2 mpd card earns 1,221 miles.

Source: tamerawmame.pages.dev

Source: tamerawmame.pages.dev

Irs Mileage Rate 2024 Calculator Staci Adelind, The rate set by the irs for business mileage, which is 65.5. In this example, your total deductible mileage related expenses would be.

Source: dollarkeg.com

Source: dollarkeg.com

How to calculate business miles for taxes Dollar Keg, The irs bumped up the optional mileage rate to 67 cents a mile in 2024 for business use, up from 65.5 cents for 2023. The irs has announced the standard mileage rates for 2024, reflecting changes that are important for taxpayers to note.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

IRS Refund Schedule 2024 When To Expect Your Tax Refund, The rate for medical or moving purposes in 2024 decreased to 21 cents. That drops to 14 cents per mile when.

Source: ashlenqmaryrose.pages.dev

Source: ashlenqmaryrose.pages.dev

Typical Mileage Reimbursement 2024 channa chelsey, Standard mileage rate for business: Irs mileage rates for 2023.

The Increase Began On January 1 And Raised The Rate From.

This was a three cent increase from the second half of 2022, when the rate was 62.5.

To Calculate Your Mileage Tax Deduction And Reduce Your Taxes, Use This Formula:

In 2023, the irs rate for the mileage tax deduction was 65.5 cents per mile.